Indirect Tax Advisory

INDIRECT TAX ADVISORY

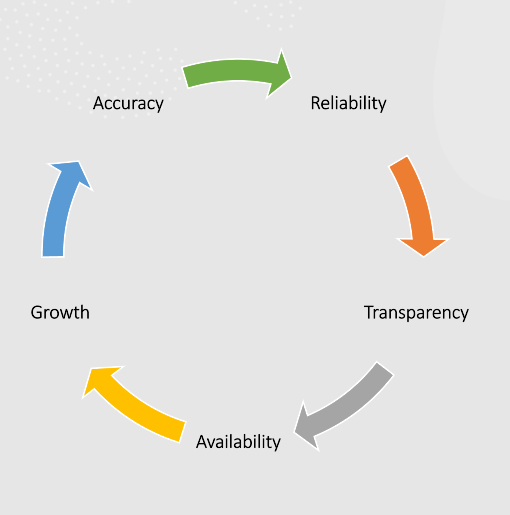

Dive into our expertise in Indirect Tax Advisory, where we navigate the complex landscape of taxation, with a special focus on Goods and Services Tax (GST). Our advisory services extend beyond traditional tax guidance, offering strategic insights into GST compliance, regulations, and optimization strategies. From meticulous assessment of GST implications to tailored solutions for diverse industries, we empower businesses to navigate the intricate web of indirect taxes. Whether it's compliance management, dispute resolution, or proactive planning, our team stands as a trusted partner, ensuring your business stays abreast of the ever-evolving Indirect Tax landscape.

Navigating Indirect Taxes: Unlocking Strategic Advantage Through Specialized Advisory Services:

Registration Assistance

- Guiding businesses through the GST registration process.

- Ensuring accurate and timely submission of registration documents.

- Providing insights into eligibility criteria and mandatory requirements

Compliance Management

- Conducting regular assessments to ensure ongoing GST compliance.

- Streamlining processes for seamless compliance with GST regulations.

-

Offering proactive advice to prevent non-compliance issues.

Optimisation Strategies

- Analyzing business operations to identify opportunities for GST optimization.

- Implementing strategies to minimize tax liabilities while maximizing benefits.

- Advising on input tax credit utilization for cost-effective operations

Annual Return & Reconciliation Statement

- Assisting in the meticulous preparation and filing of annual GST returns.

- Conducting thorough reconciliations to ensure accuracy in financial statements.

- Providing guidance on the complexities of annual return requirements.

- Proactively addressing any discrepancies and ensuring compliance with annual filing obligations.

Assessments & Appeals

- Representing businesses during GST assessments and inquiries.

- Preparing robust responses and documentation for the Appellate Authority.

- Navigating the appellate process with expertise to ensure fair and favorable outcomes.