Direct Tax Strategies

DIRECT TAX STRATEGIES

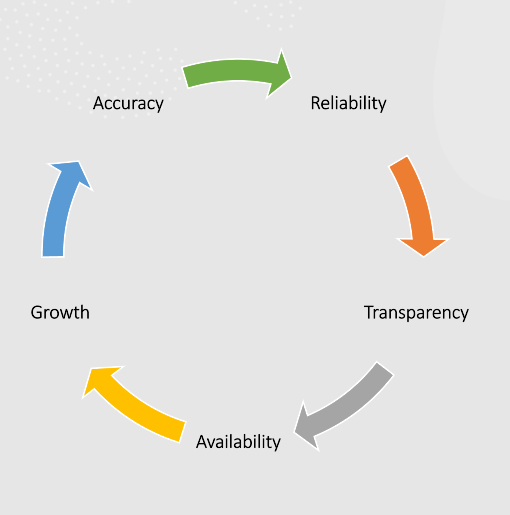

In the realm of compliance, taxes take precedence as a critical consideration for businesses. Non-compliance not only incurs monetary penalties but also tarnishes the entity's reputation. In today's dynamic corporate landscape, staying abreast of the latest tax regulations is imperative. While rooted in the Indian Tax Structure, we have evolved into international tax professionals. Partnering with businesses, we provide tailored direct tax strategies, fostering trust through our unwavering commitment and transparency.

Embark on a journey through the specialized realms of our Audit & Attestation expertise as we unveil the following distinctive services:

Tax Compliances

- Precise and timely filing of Income Tax Returns (ITR).

- Rigorous analysis to optimize tax liabilities and enhance benefits.

- Regular compliance reviews ensuring alignment with evolving tax regulations.

- Proactive identification and resolution of potential compliance issues.

Advisory & Planning

- Tailored tax planning strategies intricately linked with specific business goals.

- In-depth advisory services providing insights into the latest tax regulations.

- Strategic advice on tax implications for informed decision-making.

-

Continuous monitoring of regulatory changes to adapt strategies accordingly.

Representation & Appeals

- Expert representation during tax audits and appeals.

- Diligent preparation and filing of appeals before relevant tax authorities.

- Skillful negotiation to present a strong case on behalf of the client.

-

Strategic defense against challenges raised by tax authorities.

High Court Liaison Services

- Collaborative engagement with legal experts specializing in High Court tax litigation.

- Acting as a liaison between the client and external legal representation.

- Facilitating seamless communication and coordination throughout the legal process.

-

Ensuring the client's interests are effectively represented by trusted legal professionals.

Dispute Resolution & Settlement Services

- Strategizing effective dispute resolution mechanisms beyond appeals.

- Collaborative negotiation for settlements with tax authorities.

- Development of innovative strategies to address unique legal complexities.

- Proactive engagement in alternative dispute resolution methods.

- Constant monitoring of changing legal landscapes for adaptive resolution approaches.

Education & Empowerment

- Organizing comprehensive training sessions on evolving tax laws.

- Empowering businesses with knowledge for informed decision-making.

- Providing educational resources to keep clients abreast of regulatory changes.

- Offering ongoing support and guidance for enhanced tax literacy.